XRP Price Prediction: Can Bulls Break $2.5 Amid ETF Supercycle?

#XRP

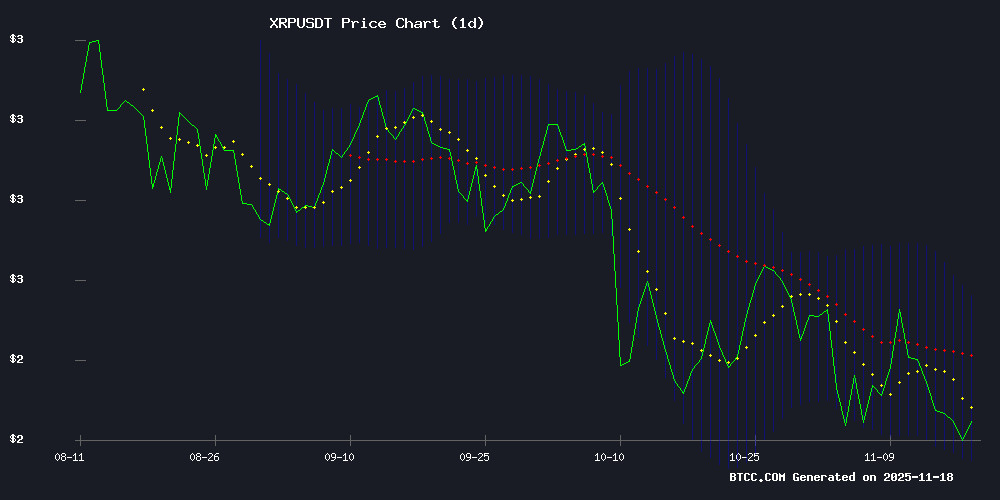

- Technical Pressure: XRP trades below 20-day MA with negative MACD, but Bollinger Bands hint at oversold conditions.

- ETF Catalyst: Competing fund launches may drive short-term speculation despite liquidity concerns.

- Remittance Potential: Analysts project $10+ targets if XRP captures significant cross-border payment share.

XRP Price Prediction

XRP Technical Analysis: Key Indicators to Watch

XRP is currently trading at 2.1505 USDT, below its 20-day moving average (MA) of 2.3329, suggesting short-term bearish pressure. The MACD histogram is negative (-0.0042), indicating weakening momentum. Bollinger Bands show the price NEAR the lower band (2.0956), which could signal an oversold condition. Analyst Ava notes that a rebound toward the middle band (2.3329) is possible if buying interest returns.

XRP Market Sentiment: ETF Hype vs. Liquidity Concerns

News headlines highlight competing XRP ETF launches by Franklin Templeton and Bitwise, fueling bullish speculation. However, questions about XRPL's liquidity efficiency and a recent whale sell-off (pushing prices below $2.20) add volatility. Ava points out that ETF Optimism may dominate sentiment, but technical resistance at $2.57 (upper Bollinger Band) remains key.

Factors Influencing XRP’s Price

Bitwise CIO Highlights Community Power Behind XRP ETF Momentum

The surge in XRP ETF demand stems not from institutional pressure but from the fervent support of a dedicated retail community. Bitwise CIO Matt Hougan observes that XRP holders' loyalty transcends market cycles, creating sustained interest in these products despite price volatility.

Index-based crypto investments dominate newcomer preferences, Hougan notes. Investors increasingly prioritize broad exposure over granular asset analysis—a trend favoring ETFs like Bitwise's upcoming XRP offering launching November 20. The phenomenon mirrors Bitcoin's early adoption curve, where community conviction preceded mainstream acceptance.

Market mechanics reveal a telling pattern: assets with passionate followings like XRP consistently outperform purely speculative tokens in ETF viability. 'You can't algorithmically manufacture this level of organic demand,' Hougan remarks, drawing parallels to Ethereum's grassroots developer ecosystem.

Bill Morgan Questions Smart Contracts’ Impact on XRPL Liquidity Efficiency

Bill Morgan has cast doubt on the wisdom of integrating smart contracts into the XRP Ledger (XRPL), arguing that such a move could undermine the network's native liquidity advantages. The XRPL currently supports decentralized finance through built-in features like automated market makers and order books—functionality that operates without reliance on smart contract layers.

Morgan warns that introducing smart contracts risks fragmenting liquidity pools and increasing transaction costs, potentially eroding the efficiency that makes XRPL attractive for cross-border settlements. His critique comes as the ledger's fast bridging capabilities face competition from smart contract-enabled chains.

The debate highlights a fundamental tension in blockchain evolution: whether to preserve optimized native functionality or embrace the programmability of smart contracts. XRP's architecture currently processes transactions in seconds without smart contracts, but faces pressure to expand its capabilities as DeFi demands grow more complex.

XRP Price Could Surge if It Captures 25% of Global Remittance Market

XRP's price could rise significantly if it captures a quarter of the global remittance market, with projections suggesting a potential value of $188.50 per token. Such a scenario would place its market capitalization at $11.31 trillion, surpassing major financial institutions like JPMorgan and Bank of America.

The global remittance market, valued at $905 billion in 2024, continues to expand, driving demand for efficient payment solutions. Ripple aims to address the $155 trillion cross-border remittance challenge by leveraging XRP as a key liquidity asset.

Currently trading around $2.25, XRP has already seen a 38,148% increase since its inception. Analysts argue the cryptocurrency remains undervalued given its utility in facilitating international transfers. Crypto researcher SMQKE suggests XRP could dominate as the leading liquidity provider for global fund transfers, with Ripple potentially securing 80% of cross-border payment flows within the next decade.

Franklin Templeton and Bitwise to Launch Competing XRP ETFs in November

Franklin Templeton is poised to enter the cryptocurrency ETF arena with its XRP-focused fund, trading under the ticker EZRP on the CBOE starting November 18. Bitwise follows closely with its own XRP ETF debut on November 20, setting the stage for a competitive showdown in the digital asset space.

Market analysts highlight Franklin Templeton's established credibility as a potential differentiator, suggesting its fund could mirror or surpass the $58 million first-day trading volume achieved by Canary Capital's XRPC ETF. The simultaneous launches signal accelerating institutional interest in XRP, yet the token's price stability indicates these developments were largely priced in by the market.

These ETF introductions are expected to funnel fresh institutional capital into XRP markets while attracting speculative interest. The coming weeks will test whether Franklin Templeton's brand recognition can translate into dominant market share against nimble crypto-native competitors.

Analysts Predict XRP Rally to $10 After Potential Retest of $1.95

XRP shows early signs of a parabolic move, with technical analysts identifying a multi-year chart structure that could propel the token toward $10. The cryptocurrency currently trades at $2.25, posting modest daily gains while recovering from recent weekly losses.

Market observers note the $1.95 level may serve as critical support before any sustained upward movement. The projected rally would represent a 400% surge from current levels, though traders caution that macroeconomic factors and regulatory developments could influence the timeline.

XRP Enters ETF Supercycle With Multiple Launches as Liquidity Model Projects $7–$24 Targets

XRP is poised for a historic week as four major asset managers prepare to launch spot exchange-traded funds, marking a watershed moment for institutional adoption. Franklin Templeton leads the charge with its November 18 debut, followed by Bitwise, 21Shares, and CoinShares in rapid succession. This clustered rollout—unprecedented in crypto ETF history—signals robust demand from traditional finance.

Franklin Templeton's $1.5 trillion asset base lends immediate credibility, with analysts anticipating institutional flows comparable to early Bitcoin and Ethereum ETF adoption. Bitwise's imminent launch after DTCC listing completion further solidifies XRP's transition from speculative asset to regulated investment vehicle. Market models suggest the ETF influx could propel XRP toward the $7-$24 range as liquidity dynamics shift.

XRP Dips Below $2.20 Amid Whale Sell-Off, Analysts See Temporary Shakeout

XRP briefly fell below $2.20 following a $200 million whale dump, sparking short-term panic among traders. The sell-off, however, proved fleeting as prices rebounded to $2.26 by Monday morning—a classic fear flush preceding recovery.

Market analysts interpret the volatility as a strategic shakeout rather than a sustained trend reversal. The rapid price recovery suggests underlying demand remains strong, with opportunistic buyers stepping in during the dip.

XRP Price Forecast: Bulls Eye $2.5 Breakout Amid Market Volatility

XRP shows resilience as it defends the $2.20 support level, outperforming peers during Bitcoin's recent pullback. Traders are watching for a decisive close above $2.30 to confirm bullish momentum, which could trigger a 10–15% rally toward $2.52.

Market sentiment hinges on upcoming U.S. macroeconomic data, including inflation figures and retail sales reports. The token's technical structure reveals a double-bottom formation at $2.18–$2.20, with Bollinger Band expansion signaling increased volatility ahead.

How High Will XRP Price Go?

XRP's near-term trajectory hinges on overcoming technical and liquidity challenges. Below is a summary of critical levels:

| Scenario | Price Target | Catalyst |

|---|---|---|

| Bullish Breakout | $2.57 (Upper Bollinger Band) | ETF inflows + remittance market growth |

| Bearish Rejection | $1.95 (Support Retest) | Whale selling + MACD downtrend |

Ava emphasizes that capturing 25% of remittance flows (as analysts suggest) could propel XRP toward $7–$24 long-term, but $2.50 is the immediate test.

html